matrix gas and renewables unlisted shares

Enquiry

About Matrix Gas And Renewables Unlisted Shares

1. Matrix Gas & Renewables Limited is strategically positioned to significantly contribute to India's growing energy demand by providing a steady supply of natural gas from diverse sources at competitive prices. The company boasts a team of experienced professionals with deep expertise in India's gas industry, ensuring reliable and innovative solutions for its customers.

2. Matrix Gas & Renewables Limited operates as a premier natural gas aggregator in India, focusing on the procurement and supply of natural gas to various industrial and commercial customers. Their services include providing competitive pricing, flexible supply contracts, and ensuring a reliable and continuous supply of natural gas. The company also supports the Indian government's initiative to increase the share of natural gas in the energy mix, thereby promoting environmental benefits and sustainability. Their commitment extends to enhancing accessibility to natural gas and reducing reliance on more polluting fuels like coal.

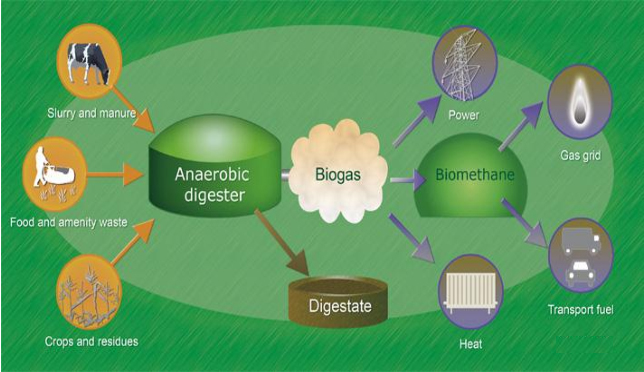

3. Matrix Gas & Renewables Limited is ambitiously expanding into the Compressed Bio-Gas (CBG) sector by setting up CBG plants nationwide. Their team is actively identifying optimal locations and sustainable raw materials, such as agri-residue, press mud, cow dung, Napier grass, potato peels, and municipal solid waste. With strong financial resources and expertise in natural gas management, Matrix Gas plans to market CBG efficiently to industrial customers and as vehicle fuel, ensuring seamless implementation and customer experience.

4. Matrix is committed to partner with customers from Concept to Commissioning of Solar Power Generation Projects, which are backed by a thorough analysis of the land, solar radiation, grid connection infrastructure and emerging technologies.They consider various factors such as the geographical location, climate conditions, temperature and its impact on equipment, local facilities as well as potential maintenance requirements. We thus ensure that all our capital investment projects are carried out after considering and studying the risks involved.

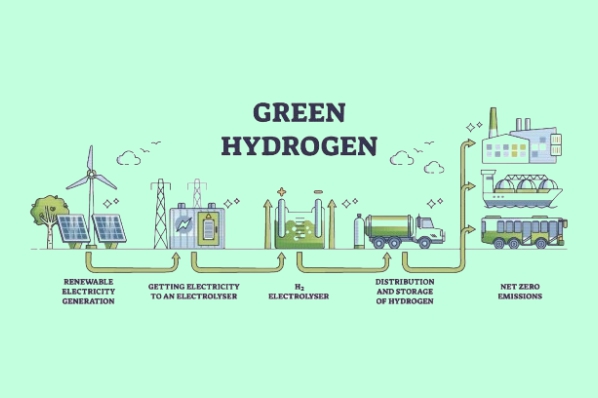

5. Matrix Gas & Renewables Ltd: Advancing in Green Hydrogen

Matrix Gas & Renewables Ltd is pioneering in the clean energy transition by focusing on Green Hydrogen production. They have developed technical expertise and a professional team to execute Engineering Procurement and Commissioning (EPC) and Build Own Operate (BOO) projects. The company plans to establish a manufacturing plant with a 2 GW hydrogen electrolyser capacity, crucial for low-cost, high-quality hydrogen production. Matrix's capabilities span the entire Green Hydrogen supply chain, including production, storage, transportation, dispensing, and Green Ammonia production.

6. Promoted by diversified groups, including Gensol Engineering Ltd. and BluSmart Mobility, Matrix Gas has strong foundations in renewable energy and electric mobility. Gensol Engineering is known for its solar EPC and O&M services, while BluSmart is India's leading EV ride-hailing service and EV charging infrastructure operator.

7. Matrix Gas aims to become the preferred supplier of natural gas aggregation to Indian downstream customers. The company has plans to source gas on a medium to long-term basis, ensuring a reliable supply for customer needs. Matrix Gas specializes in developing flexible offtake contracts, offering weekly or fortnightly supply terms and flexible take or pay and LC requirements.

8. Matrix Gas has a proven track record in the gas aggregation business, having handled gas volumes of 100 million standard cubic meters to date. The company is recognized for delivering reliable and efficient solutions, providing tailored services that offer flexibility and reliability in the gas supply chain to its esteemed Indian customers.

Key Managerial Person:

1. Anmol Singh Jaggi is the Chairman and Director of Gensol Engineering Ltd., India's largest clean energy services company. As a visionary entrepreneur, he also founded BluSmart, India's leading B2C electric mobility brand. His leadership and strategic vision have significantly advanced clean energy and electric mobility in India.

2. Chirag Kotecha, CEO and Managing Director, is a seasoned professional with over 18 years of experience in the Oil & Gas industry, focusing on LNG and Natural Gas. He has held key roles at GSPC, Gujarat Gas, Adani Total, and Indian Gas Solutions. With expertise in business development, contracts, regulation, and marketing, Chirag holds a Bachelor's in Electronics Engineering and an MBA in Finance, demonstrating his technical and commercial versatility.

Valuation of Matrix Gas Unlisted IPO Shares

As on 31.10.2023

No. of Shares Outstanding = 18014666

After that Matrix Gas Unlisted Share has issued shares in Various Tranches;

| Date | No. of Shares |

| 17.11.2023 | 250000 |

| 12.12.2023 | 13333 |

| 09.12.2023 | 400000 |

| 29.02.2024 | 967500 |

| 01.03.2024 | 1338750 |

| 07.03.2024 | 1296000 |

| 11.03.2024 | 1565000 |

| 15.03.2024 | 307500 |

| 15.03.2024 | 1116250 |

| 22.04.2024 | 575000 |

| 08.07.2024 | 375000 |

So, after adding all these shares, the total outstanding shares as on 08.07.2024 = ~2.6 Cr ( 26218999 )

Total Share Outstanding ~2.6 Cr.

At Unlisted Pre-IPO Price of INR 900 per share, the Mcap is INR 2300 Cr.

Expected PAT Numbers in Fy25 - 98 Cr

Expected Forward P/E = 25x.

| Price Per Equity Share | ₹ 775 |

| Lot Size | 100 Shares |

| 52 Week High | ₹ 1075 |

| 52 Week Low | ₹ 775 |

| Depository | NSDL & CDSL |

| PAN Number | AAHCG2065R |

| ISIN Number | INE0PO201010 |

| CIN | U74999GJ2018PLC101075 |

| RTA | Link Intime |

| Market Cap (in cr.) | ₹ 2032 |

| P/E Ratio | 63.52 |

| P/B Ratio | 37.62 |

| Debt to Equity | 0.66 |

| ROE (%) | 72.73 |

| Book Value | 20.6 |

| Face Value | 10 |

| Total Shares | 26218999 |

Financials

| P&L Statement | 2022 | 2023 |

|---|---|---|

| Revenue | 0.45 | 489 |

| Cost of Material Consumed | 0 | 443 |

| Gross Margins | 100 | 9.41 |

| Change in Inventory | 0 | 0 |

| Employee Benefit Expenses | 0 | 1 |

| Other Expenses | 0.04 | 0.5 |

| EBITDA | 0.41 | 44.5 |

| OPM | 91.11 | 9.1 |

| Other Income | 0.15 | 0.5 |

| Finance Cost | 0.43 | 3 |

| D&A | 0 | 0 |

| EBIT | 0.41 | 44.5 |

| EBIT Margins | 91.11 | 9.1 |

| PBT | 0.12 | 43 |

| PBT Margins | 26.67 | 8.79 |

| Tax | 0.03 | 11 |

| PAT | 0.09 | 32 |

| NPM | 20 | 6.54 |

| EPS | 90 | 11.85 |

| Financial Ratios | 2022 | 2023 |

|---|---|---|

| Operating Profit Margin | 91.11 | 9.1 |

| Net Profit Margin | 20 | 6.54 |

| Earning Per Share (Diluted) | 90 | 11.85 |

| P&L Statement | 2022 | 2023 |

|---|---|---|

| Revenue | 0.45 | 489 |

| Cost of Material Consumed | 0 | 443 |

| Gross Margins | 100 | 9.41 |

| Change in Inventory | 0 | 0 |

| Employee Benefit Expenses | 0 | 1 |

| Other Expenses | 0.04 | 0.5 |

| EBITDA | 0.41 | 44.5 |

| OPM | 91.11 | 9.1 |

| Other Income | 0.15 | 0.5 |

| Finance Cost | 0.43 | 3 |

| D&A | 0 | 0 |

| EBIT | 0.41 | 44.5 |

| EBIT Margins | 91.11 | 9.1 |

| PBT | 0.12 | 43 |

| PBT Margins | 26.67 | 8.79 |

| Tax | 0.03 | 11 |

| PAT | 0.09 | 32 |

| NPM | 20 | 6.54 |

| EPS | 90 | 11.85 |

| Financial Ratios | 2022 | 2023 |

|---|---|---|

| Operating Profit Margin | 91.11 | 9.1 |

| Net Profit Margin | 20 | 6.54 |

| Earning Per Share (Diluted) | 90 | 11.85 |