sbi general insurance unlisted shares

Enquiry

About SBI General Insurance Unlisted Shares

SBI General Insurance was started as a joint venture between the State Bank of India (SBI) and Insurance Australia Group (IAG). But in 2019, IAG exited fully in the company. It offers a range of general insurance products in India, including health, motor, home, travel, and personal accident insurance Ever since SBI General Insurance establishment in 2009, the growth has been exponential in various aspects. They have expanded their presence from 17 branches in 2011 to over 139 branches pan-India. Till date, they have served over 10 crore customers. They have been awarded ‘Insurer of the Year’ in the non-life category at FICCI Insurance Industry Awards, for two consecutive years in 2020 & 2021. In 2022, recognized as the 'Best General Insurance Company of the Year' at the 'Third Emerging Asia Insurance Awards' organized by the 'Indian Chamber of Commerce.

They have a robust multi-distribution model encompassing Bancassurance, Agency, Broking, Retail Direct Channels and Digital tie-ups. The widespread network of distributors like 22000 plus SBI branches, Agents, other financial alliances, OEMs, and multiple digital partners enable us to extend the reach to the pocketed remote areas of India. They offer a bouquet of products spread across various lines of businesses that cater to customers across all segments like Retail, Corporate, SME and Rural, ensuring accessibility via i.e., digital as well as physical modes.

SBI General Insurance reported a 11% growth in Gross Written Premium (GWP) in FY 2021-22 and the GWP stood at INR 9260 crore. With the increasing need of health insurance, we have a very channelized strategy for health insurance business, which has reflected in 50% growth in health insurance GWP for the FY2021-22.

With its headquarters in Mumbai, SBI General Insurance has a pan-India presence through a network of over 23,000 branches of State Bank of India and its associated banks. The company has a strong focus on customer-centricity and aims to provide innovative, affordable and accessible insurance solutions to individuals, businesses, and communities across the country. SBI General Insurance has won several awards and recognitions for its services, including the 'General Insurer of the Year' award at the Indian Insurance Awards in 2020. The company has a strong financial backing and is known for its quick and hassle-free claims settlement process.

Key events in the history of SBI General Insurance Unlisted Shares

2009: SBI and IAG sign a joint venture agreement to establish SBI General Insurance.

2010: SBI General Insurance begins its operations with a focus on personal and commercial insurance products.

2012: The company expands its product portfolio to include health insurance and travel insurance.

2013: SBI General Insurance launches its group health insurance product for corporates.

2014: The company introduces its crop insurance product for farmers.

2015: SBI General Insurance crosses the milestone of 1 million policies.

2016: The company launches its cyber insurance product for individuals and businesses.

2017: SBI General Insurance introduces its title insurance product for the real estate sector.

2018: The company launches its first-ever TV advertising campaign.

2019: SBI General Insurance introduces its home insurance product for homeowners and renters.

2020: The company wins the 'General Insurer of the Year' award at the Indian Insurance Awards

2021: SBI General Insurance crosses the milestone of 10 million policies.

Key Events in Funding in SBI General Insurance Unlisted Shares

In September of 2018, the business parted ways with 4% of its ownership in exchange for 4.82 billion (US$60 million) crore to Axis Asset Management Company and Premji Invest. IAG sold its entire stakes through the sale of its whole 26 percent stake in October of 2019.

Out of this total, 16.01 percent of the stock was acquired by Napean Opportunities LLP, which is a subsidiary of Premji Invest. Warburg Pincus acquired the remaining 9.99 percent of the stake. In the same year, the company announced a Bancassurance tie-Up with Karnataka Gramin Bank and formed a partnership with PolicyBazaar to sell travel insurance to people who were going to be travelling outside of India.

Premji and Warbug Pincus entered as investors in SBI General Insurance Unlisted Shares

In 2019, Insurance Australia Group (IAG) has sold its entire 26 percent stake in SBI General to Premji Invest and Warburg Pincus for approximately ₹₹3,200 crore, valuing the company at ₹12,800 crore. Premji Invest (Premji) has acquired 16.01 per cent and Warburg Pincus Group 9.99 per cent in the company. In 2019, IAG was looking to focus on its core territories of Australia and New Zealand, and has exited other markets in emerging Asia.

Valuation of SBI General Insurance Unlisted Shares when IAG sold its stakes

In 2019, IAG has sold its entire stakes in the company at ~12500 Crores and at that time GDP (Gross Direct Premium ) of SBI General Insurance was ~4800 Crores, So, deal was done at Mcap/GDP of 2.6x.

Financial Performance of SBI General Insurance Unlisted Shares in 2022

SBI General Insurance underwrote gross direct premiums totaling Rs. 9,166 crore during the fiscal year 2022, which indicates an annual growth rate of 10.9% over the previous year in comparison to an industry growth rate of 11.03%. SBI General Insurance’s health portfolio, which expanded at a rate of 48% and accounted for approximately 20% of the company's overall premium portfolio, was the key driver for growth.

A growth rate of 17% was seen throughout the year in SBI General's Motor portfolio, which is their most important segment. SBI General Insurance has also adjusted its growth strategy in the crop segment, which had previously displayed significant losses. This was done in order to improve the segment's performance. As a direct consequence of this, the premium in this sector had a fall of 3% over the course of the fiscal 2022 year, and its proportion of the whole portfolio fell from 28% to 24%.

The significant increase in Covid-19 claims filed during the fiscal year 2022 had an effect on the underwriting result. In the current fiscal year (2022), the claims ratio was 86.3%, compared to 74.1% in the previous fiscal year (2021), and less than 5% of the claims in the current fiscal year were against Covid-19 losses.

As a direct consequence of this, the combined ratio for the company's fiscal year 2022 was significantly higher than its typical level, coming in at 113.7%. The performance for Q1 2023, on the other hand, has picked up, as seen by a claims ratio of 68.8% and a combined ratio of 99.5%. This is due to the progressive decline in the number of Covid-19 occurrences.

Strengths of SBI General Insurance Unlisted Shares

1.SBI, the parent organisation provides major administrative, financial, and branding support to the subsidiary, which plays a crucial role in SBI's overall strategy. This is reflected in the bank's high involvement in the functioning of SBI General as well as in the representation of SBI's directors on the board of SBI General, including the chairman of SBI, who also serves as the chairman of SBI General's board.

2. As indicated by the fact that the company's net worth was stated to be 3,013 crore as of June 30, 2022, capitalization is still sufficient in respect to the company's nature and scale of activity. During the past three years, the cushion in solvency ratio has been comfortable, and the solvency ratio has remained over two times since that time. The reported solvency ratio was 1.94 times as of the 30th day of June, 2022. The corporation and its parent organisation, SBI, aspire to keep a solvency ratio of at least 1.7 times or higher when operating in a state of steady-state operation.

3. SBI General Insurance Unlisted Share has managed to keep a premium mix that is quite broad over the years, in contrast to the greater emphasis that the sector as a whole places on conventional segments such as vehicle and health insurance. In addition to more traditional business areas such as the motor (27%) and health (20%) industries, the company has also been concentrating on the fire (15%) and crop business (24%). The corporation makes an effort to keep its exposure to any one segment at or below thirty percent on a steady-state basis.

4. The performance of the company's underwriting department has improved more quickly than that of its competitors in the ten years that it has been in business. For the five years leading up to the fiscal year 2021, the business maintained a combined ratio of 93-97% of its total revenue, resulting in an underwriting surplus for each of these years. Its claims ratio for the period was 70-75%, which is on par with the majority of well-performing firms in the sector; nonetheless, the primary factor contributing to its strong underwriting performance is its low commission and expense ratio. Because SBI General is the exclusive insurance partner of SBI, it gets access to the footfall at SBI branches, which reduces the amount of money spent on sourcing. Because of this affiliation, SBI General is able to source business from SBI, which acts as its bancassurance partner, at commission rates that are more favourable than those offered by competitors. This is an additional significant benefit. This channel contributes up to thirty percent of the total revenue generated by the corporation.

Weakness of SBI General Insurance Unlisted Shares

1. Although underwriting has performed better than the industry average, it has made a relatively little contribution to the company's overall profit. As a result, much like the rest of the business, the company's profitability are largely based on income from investments. The net profit of Rs 131 crore for the fiscal year 2022 was made up of an underwriting deficit of Rs 622 crore due to Covid-19 losses and investment income of Rs 838 crore. Earnings during the first quarter of 2023 recovered thanks to better underwriting performance; net profit was Rs. 139 crore. A rise in combined ratio could limit underwriting performance over the medium term, which would have a brief but minimal effect on total profitability.

2. With its share rising to one-third of the total premium mix after 2017, compared to less than one-fifth for the entire industry, crop insurance has become a key business area for SBI General. This development has been fueled by SBI's extensive rural reach and presence and its affiliation with regional rural banks (RRBs). The corporation is hence subject to innate difficulties like natural disasters ruining harvest and erratic monsoon, which may result in high claim volumes. Nonetheless, 80% of the company's agricultural business is reinsured, which lessens the net impact. Due to an increase in the claims ratio from 135.3% to 135.6%, the combined ratio for this segment increased from 128.5% in fiscal 2018 to 151.4% in fiscal 2022. The spending ratio in the agricultural segment, in particular for the fiscal year 2022, was high at 15.8% compared to less than 10% in prior years.

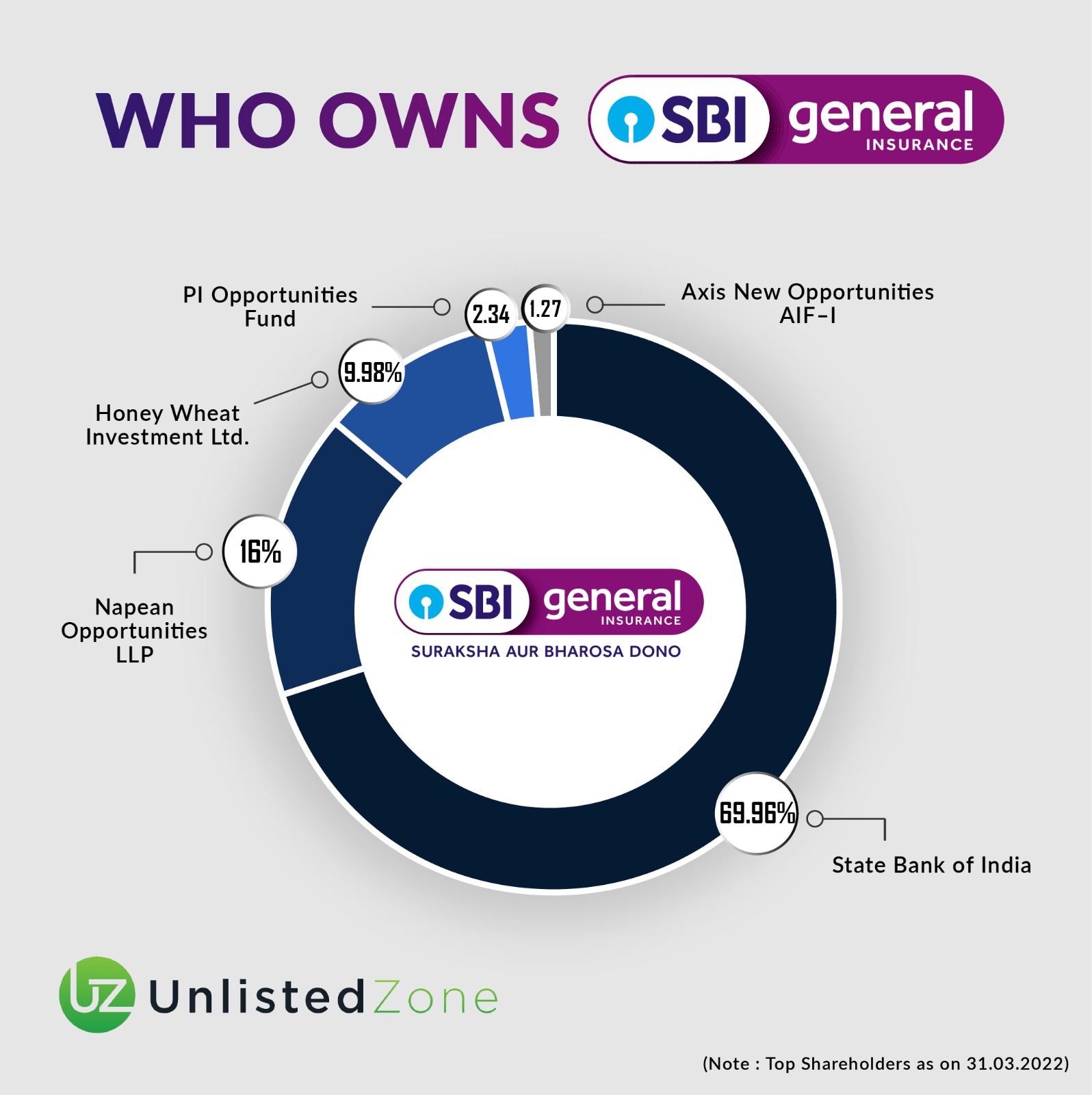

Shareholders of SBI General Insurance Unlisted Shares As on 31.03.2022

Out of the 74% stake in the Company, SBI had in mid - 2018 divested 4% stake to PI Opportunities Fund - I (2.35%) and Axis New Opportunities - AIF-I (1.65%). Further, IAG, the erstwhile JV partner of 26%, exited in March 2020, thereby divesting its entire stake of 26% to Napean Opportunities LLP (16.01%) and Honey Wheat Investments Ltd (9.99%). Other shareholders in the company are;, Axis New Opportunities - AIF-I (1.27%) and Avendus Future Leaders Fund I &II (0.38%).

Valuation of SBI General Insurance Unlisted Share

As per media reports, AXIS AIF has sold 1.27% stakes in SBI General Insurance to IIFL for ~350 Crores on 12.01.2023. If you do the reverse calculation, the 100% stake value of SBI General Insurance would be ~27000 Crores. So, Mcap/GWP is = 2.91x based on GWP number upto 31.03.2022. The valuation will come down further if we take GWP number of Fy23.

Note: Check the Latest SBI General Insurance Unlisted Shares Price at UnlisteZone Android or iOS Mobile App.

| Price Per Equity Share | ₹ 1150 |

| Lot Size | 250 Shares |

| 52 Week High | ₹ ** |

| 52 Week Low | ₹ ** |

| Depository | NSDL & CDSL |

| PAN Number | AAMCS8857L |

| ISIN Number | INE01MM01017 |

| CIN | U66000MH2009PLC190546 |

| RTA | KFin Technology |

| Market Cap (in cr.) | ₹ 25689 |

| P/E Ratio | 107.48 |

| P/B Ratio | 6.2 |

| Debt to Equity | N/A |

| ROE (%) | 5.77 |

| Book Value | 185.53 |

| Face Value | 10 |

| Total Shares | 223380000 |

Financials

| P&L Statement | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| GWP | 8312 | 9260 | 10828 | 12553 |

| NEP | 3491 | 4264 | 5746 | 8499 |

| Premium Earned | 3490 | 4264 | 4884 | 7050 |

| P&L on Sale of Investment | 63 | 63 | -0.4 | 0.79 |

| Interest, Dividend and Rent | 430 | 475 | 624 | 825 |

| Others Revenue | 4 | 9 | 82 | 3.86 |

| Total Revenue | 3987 | 4811 | 5589.6 | 7879.65 |

| Claims Incurred | 259 | 3680 | 3845 | 6056 |

| Commission | -147 | -109 | 62 | 720 |

| Operating Expenses | 1033 | 1314 | 1547 | 1177 |

| Others Revenue Account | 0 | 0 | 0 | 0 |

| Operating Profit | 2842 | -74 | 135.6 | -73.35 |

| Income from Investment | 206 | 271 | 205 | 401 |

| Other Income | 4 | 12 | 13 | 6.38 |

| Other Expenses | 6 | 31 | 110 | 17.22 |

| PBT (%) | 718 | 178 | 244 | 318 |

| Tax | 175 | 47 | 60 | 79 |

| PAT | 543 | 131 | 184 | 239 |

| EPS | 25.2 | 6.08 | 8.53 | 10.7 |

| Financial Ratios | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Combined Ratio | 32.81 | 114.56 | 111.67 | 112.81 |

| Net-Loss Ratio | 0.07 | 0.86 | 0.79 | 0.86 |

| Mcap / GWP | 2.98 | 2.68 | 2.29 | 2.05 |

| P&L Statement | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| GWP | 8312 | 9260 | 10828 | 12553 |

| NEP | 3491 | 4264 | 5746 | 8499 |

| Premium Earned | 3490 | 4264 | 4884 | 7050 |

| P&L on Sale of Investment | 63 | 63 | -0.4 | 0.79 |

| Interest, Dividend and Rent | 430 | 475 | 624 | 825 |

| Others Revenue | 4 | 9 | 82 | 3.86 |

| Total Revenue | 3987 | 4811 | 5589.6 | 7879.65 |

| Claims Incurred | 259 | 3680 | 3845 | 6056 |

| Commission | -147 | -109 | 62 | 720 |

| Operating Expenses | 1033 | 1314 | 1547 | 1177 |

| Others Revenue Account | 0 | 0 | 0 | 0 |

| Operating Profit | 2842 | -74 | 135.6 | -73.35 |

| Income from Investment | 206 | 271 | 205 | 401 |

| Other Income | 4 | 12 | 13 | 6.38 |

| Other Expenses | 6 | 31 | 110 | 17.22 |

| PBT (%) | 718 | 178 | 244 | 318 |

| Tax | 175 | 47 | 60 | 79 |

| PAT | 543 | 131 | 184 | 239 |

| EPS | 25.2 | 6.08 | 8.53 | 10.7 |

| Financial Ratios | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Combined Ratio | 32.81 | 114.56 | 111.67 | 112.81 |

| Net-Loss Ratio | 0.07 | 0.86 | 0.79 | 0.86 |

| Mcap / GWP | 2.98 | 2.68 | 2.29 | 2.05 |