sbi mutual fund unlisted shares

Enquiry

About SBI Mutual Fund Unlisted Shares

SBI Funds Management Ltd. (SBIFML), with 36 years of experience, is a joint venture between the State Bank of India (SBI) and AMUNDI, a global fund management company. SBI holds a 63% stake, while AMUNDI owns the remaining 37%. This partnership, formalized in April 2011, aims to develop SBIFML into an internationally reputable asset management company, adopting global best practices and maintaining international standards.

SBIFML prioritizes its investors, focusing on mutual funds as a viable investment option for the masses in India. The company offers a range of services, including managing domestic mutual funds, offshore funds, Alternative Investment Funds, and providing portfolio management advisory services for institutional investors. Innovative and need-specific products have been developed to educate investors about the benefits of investing in capital markets via mutual funds.

The company's investment strategy is crafted by a team of expert fund managers and analysts who monitor market changes and manage complex portfolios. Their approach includes optimum securities selection, intensive research, and active monitoring, aiming to minimize risks while safeguarding investor interests. The goal is to outperform benchmarks with well-researched investments in Indian equities and debt markets, creating portfolios that could be blended, large cap, mid cap, or sector-oriented.

SBIFML's research team prepares comprehensive analytical reports on various sectors to identify high-performance stocks. They focus on innovative products, stock selection, and active portfolio management, enhancing and optimizing asset allocation and stock selection based on internal and external research.

As of November 2022, Mr. Shamsher Singh, a veteran with over 32 years of experience in the State Bank of India, serves as the Deputy Managing Director of SBIFML. Prior to this, he was the Chief General Manager of SBI's Ahmedabad Circle, responsible for business growth and regulatory compliance across over 1400 branches.

SBIFML offers a variety of mutual fund categories, including:

1. Equity Mutual Funds: Designed for long-term capital growth, with an investment horizon of over five years.

2. Solution-Oriented Schemes: Aimed at retirement planning and children's benefits.

3. Debt Mutual Funds: Intended for regular income generation, suitable for investment periods ranging from one day to three years.

4. Other Funds: This category includes Index Funds, ETFs (Exchange Traded Funds), and FOFs (Funds of Funds).

5. Hybrid Mutual Funds: Targeted for both regular income and capital appreciation, with an investment period of three to five years.

In summary, SBIFML stands as a prominent player in India's asset management landscape, leveraging its extensive experience, strong lineage, and innovative strategies to offer a diverse range of investment products and services.

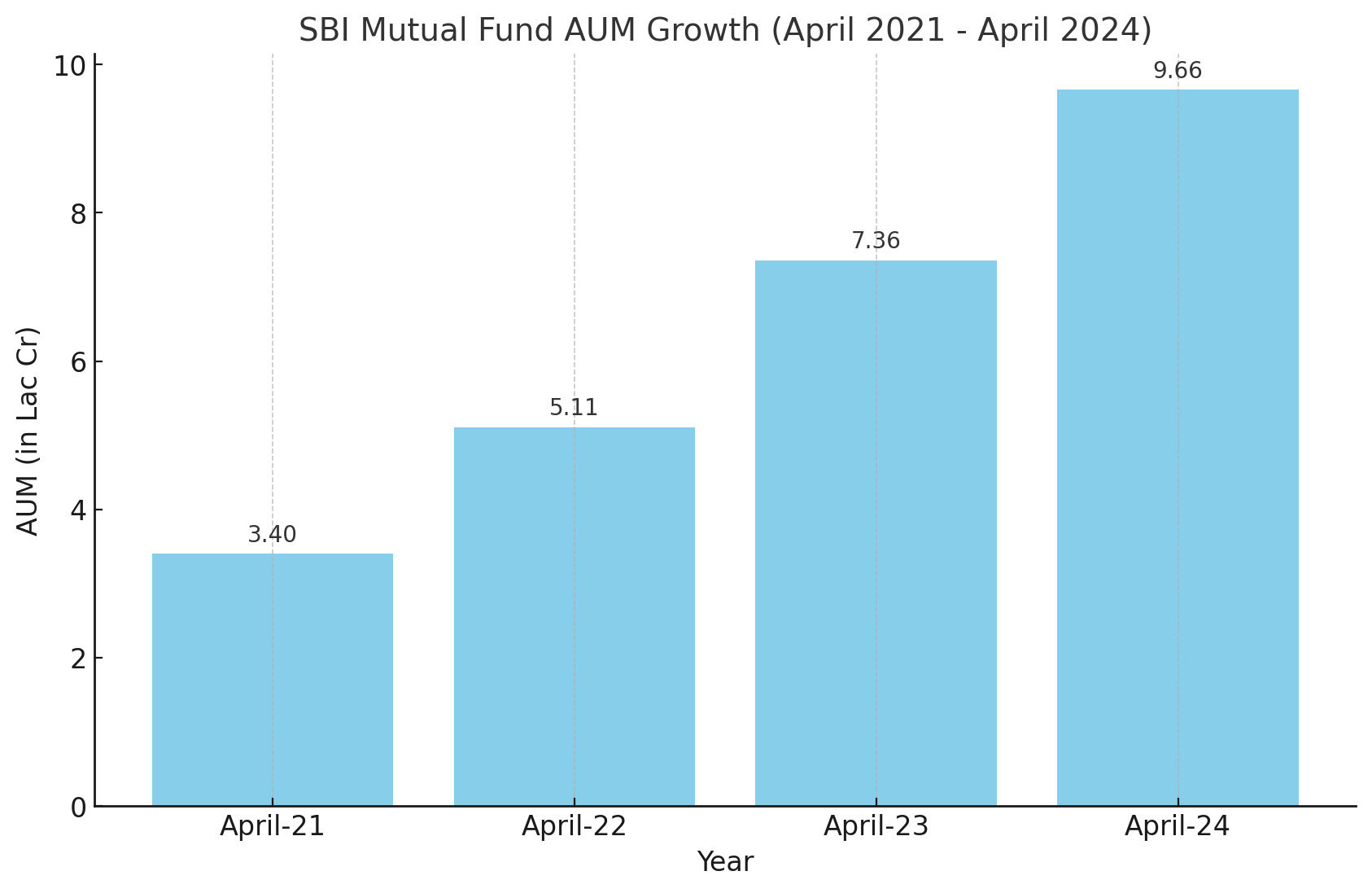

AUM Growth in last 4 years

| Price Per Equity Share | ₹ 675 |

| Lot Size | 100 Shares |

| 52 Week High | ₹ 2775 |

| 52 Week Low | ₹ 675 |

| Depository | NSDL & CDSL |

| PAN Number | AAACS7339D |

| ISIN Number | INE640G01020 |

| CIN | U65990MH1992PLC065289 |

| RTA | Computer Age Management Services (CAMS) |

| Market Cap (in cr.) | ₹ 137122 |

| P/E Ratio | 54 |

| P/B Ratio | 16.52 |

| Debt to Equity | 0 |

| ROE (%) | 30.61 |

| Book Value | 40.85 |

| Face Value | 1 |

| Total Shares | 2031443768 |

Financials

| P&L Statement | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 1437 | 1958 | 2303 | 3273 | 4063 |

| Cost of Material Consumed | 0 | 0 | 0 | 0 | 0 |

| Gross Margins | 100 | 100 | 100 | 100 | 100 |

| Change in Inventory | 0 | 0 | 0 | 0 | 0 |

| Employee Benefit Expenses | 240 | 288 | 326 | 368 | 421 |

| Other Expenses | 216 | 138 | 276 | 339 | 403 |

| EBITDA | 981 | 1532 | 1701 | 2566 | 3239 |

| OPM | 68.27 | 78.24 | 73.86 | 78.4 | 79.72 |

| Other Income | 19 | 52 | 109 | 165 | 187 |

| Finance Cost | 4 | 4.4 | 5 | 8 | 8.6 |

| D&A | 31 | 33 | 34 | 37 | 39 |

| EBIT | 950 | 1499 | 1667 | 2529 | 3200 |

| EBIT Margins | 66.11 | 76.56 | 72.38 | 77.27 | 78.76 |

| PBT | 1138 | 1439 | 1782 | 2686 | 3379 |

| PBT Margins | 79.19 | 73.49 | 77.38 | 82.07 | 83.17 |

| Tax | 276 | 357 | 442 | 613 | 839 |

| PAT | 862 | 1082 | 1340 | 2073 | 2540 |

| NPM | 59.99 | 55.26 | 58.18 | 63.34 | 62.52 |

| EPS | 17.24 | 21.64 | 26.64 | 40.98 | 50.02 |

| Financial Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Operating Profit Margin | 68.27 | 78.24 | 73.86 | 78.4 | 79.72 |

| Net Profit Margin | 59.99 | 55.26 | 58.18 | 63.34 | 62.52 |

| Earning Per Share (Diluted) | 17.24 | 21.64 | 26.64 | 40.98 | 50.02 |

| P&L Statement | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 1437 | 1958 | 2303 | 3273 | 4063 |

| Cost of Material Consumed | 0 | 0 | 0 | 0 | 0 |

| Gross Margins | 100 | 100 | 100 | 100 | 100 |

| Change in Inventory | 0 | 0 | 0 | 0 | 0 |

| Employee Benefit Expenses | 240 | 288 | 326 | 368 | 421 |

| Other Expenses | 216 | 138 | 276 | 339 | 403 |

| EBITDA | 981 | 1532 | 1701 | 2566 | 3239 |

| OPM | 68.27 | 78.24 | 73.86 | 78.4 | 79.72 |

| Other Income | 19 | 52 | 109 | 165 | 187 |

| Finance Cost | 4 | 4.4 | 5 | 8 | 8.6 |

| D&A | 31 | 33 | 34 | 37 | 39 |

| EBIT | 950 | 1499 | 1667 | 2529 | 3200 |

| EBIT Margins | 66.11 | 76.56 | 72.38 | 77.27 | 78.76 |

| PBT | 1138 | 1439 | 1782 | 2686 | 3379 |

| PBT Margins | 79.19 | 73.49 | 77.38 | 82.07 | 83.17 |

| Tax | 276 | 357 | 442 | 613 | 839 |

| PAT | 862 | 1082 | 1340 | 2073 | 2540 |

| NPM | 59.99 | 55.26 | 58.18 | 63.34 | 62.52 |

| EPS | 17.24 | 21.64 | 26.64 | 40.98 | 50.02 |

| Financial Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Operating Profit Margin | 68.27 | 78.24 | 73.86 | 78.4 | 79.72 |

| Net Profit Margin | 59.99 | 55.26 | 58.18 | 63.34 | 62.52 |

| Earning Per Share (Diluted) | 17.24 | 21.64 | 26.64 | 40.98 | 50.02 |

Shareholding Patterns

Progress for 2021

Progress for 2021

Events

Promoters or Management

Frequently Asked Questions

Your Questions About Unlisted Stocks, Answered

Please find below the procedure for buying SBI Mutual Fund Unlisted Shares. at Unlistedbuzz. 1. You confirm booking of SBI Mutual Fund Unlisted Shares. with us at a trading price. 2. You provide your client master report (ask the broker if not available) along with PAN Card and Cancelled Cheque in case you are not transferring funds from the bank account as mentioned in the CMR Copy. These are KYC documents required as per SEBI regulations. 3. We Will Provide the Bank details. You need to transfer funds to that account. 4. Payment has to be done in RTGS/NEFT/IMPS CHEQUE TRANSFER. No CASH DEPOSIT. 5. Payment has to be done from the same account in which shares are to be credited.